The Top Relationship Killer in Capital Markets

Plus, My First Score Revealed: The Great Bear Returns, Northern Miner's New Home, and the Best Investment in Junior Mining

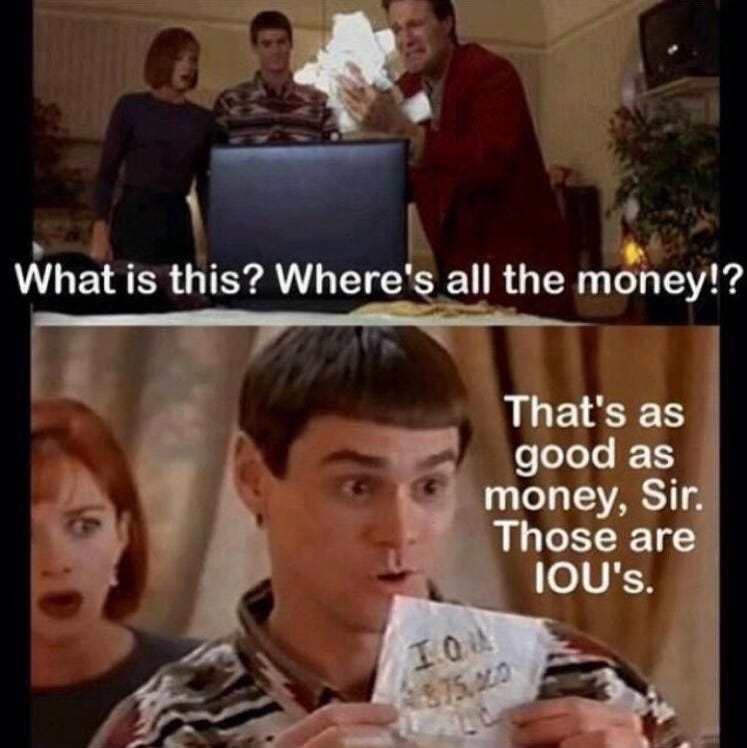

Imagine a scenario where an old friend, the CEO of a small mining company, turns to you for help in finding big investors. You connect him with key players, and a deal takes shape. Yet, all you get in return is a brief "thank you" text. Resentment simmers.

Now, put yourself in the CEO's shoes. Raising money is a gruelling task, and yet, you receive no special acknowledgment. It feels as if everyone’s hand is in your pocket. Why pay someone who did less work and had no formal agreement? It's frustrating.

Let's also consider the case of the connector, working a different file. Soon after his finder's agreement expires, two people he introduced announce a huge merger. Naturally, he demands his share, but the CEO resists, and only the lawyers benefit.

The truth is, emotions like fear, pride, and self-centeredness affect everyone. Stubbornness creeps in, eroding even the strongest bonds.

In the absence of formal agreements, finders depend on the strength of their relationships. But, compensation without obligation is rare in the financial world.

Experienced finders are forward-thinkers. Clearly defined terms prevent grudges, while unspoken expectations lead to disappointment.

Here's my perspective: For deals under $10 million, a 1% commission for introductions seems friendly. For transactions on the TSX-Venture exchange, finders who played a significant role can receive up to 5%, scaled down for larger deals.

For CEOs, rewarding finders is an investment in future deal flow. Value relationships over deals. Let me know what you think?

My First Score in Copper

At a bustling Cape Town mining conference in 2014, a young Canadian investor meets a seasoned Californian geologist.

The geologist drops a hint about a forgotten Mexican copper play, partly owned by the investor's friend.

The investor introduces the geologist and his friend via email, but the connection fades amid their busy schedules.

Six weeks later, the company holding the copper asset announces a $1.2 million loan, led by the investor's friend. Armed with only the geologist's clue, the young investor asks for a small piece of the loan and gets it.

Time passes, and the loan transforms into equity units with 7-cent shares and 10-cent warrants. The pre-money valuation sits at a mere $650,000 in an abandoned sector.

As the deal concludes, the investor is astonished to discover that two renowned mining executives have acquired significant stakes in the company. One chairs a major gold producer, the other has created billions in shareholder value through project development. They soon join the company's board.

The company's stock soars to over 50 cents per share, turning each 7-cent unit into 93 cents—an astounding 1230% return in just six months.

In mining’s endless musical chairs game, the Mexican copper company eventually merges with a Californian gold firm, then joins forces with a gold miner consolidator. The copper projects eventually spin out into another venture, Solaris Resources ($872M market cap).

This experience underscores the value of serendipity in the mining industry. Building relationships with technical experts and dealmakers during bear markets can unveil valuable clues when bull markets emerge.

It emphasises the importance of attending conferences and the transformative influence of new management in a deal. The same asset in different hands can have radically different values.

The geologist who offered the initial clue received no fee for the idea. The young investor, who reaped a staggering return in just six months, offers heartfelt thanks to John-Mark Staude, CEO of Riverside Resources, for his valuable insight.

The Great Bear Returns

Junior mining speculators, much like Indiana Jones, set off on a treasure hunt filled with booby traps.

But in good times, the quantity of money seeking a good home far outweighs the opportunities.

Ian Telfer, the former head honcho of the gold major mentioned earlier, compares good times in the mining market to squeezing a big whiskey bottle into a shot glass—money flows everywhere. The same idea holds true for companies.

A Wednesday press release from a lesser-known firm carried a vague headline. But, thanks to an AI summary, investors perked up.

Here's the scoop: A CEO who just sold his company for a whopping $1.8 billion has taken charge of a tiny $1.3 million shell.

Between 2016 and 2022, geologist Chris Taylor, now 45, famously led Great Bear Resources' Dixie gold find from 10 cents to over $28 a share.

On a side note, I was one of the few 10-cent Great Bear holders who didn't cash in, missing out on nearly $4 million. Read: That Time I Threw a Picasso in the Garbage Can

Taylor just grabbed a 19.2% stake in Railtown Capital (RLT-P-TSXV) and was appointed CEO. Railtown is raising $1 million at 10 cents per share. Before this news, Railtown (RLT-P:TSXV) traded for 9 cents. Now, it's up to 35 cents, putting the post-deal value at around $8.05 million, with $1.6 million in cash (based on 23 million shares at 35 cents).

It's crucial to point out that Railtown doesn't have a project yet, hinting at potential future equity dilution. However, Taylor's impressive track record and financial resources offer hope.

I had my eye on Tim Gamble, a pal and one of Railtown's founders. Soon after the news broke, I contacted him, expressing my interest in the financing. I don't expect to snag a spot in a $1 million seed round, especially after the CEO's massive $1.5+ billion win for his previous venture's investors, but it's worth a shot. Tim quipped, "You only call me for money!"

Similar to my 2014 Mexican copper investment, Railtown's $1 million deal presents a cheap entry with strong new management. That's exactly where you want to be—a drop of whiskey clinging to the bottom of the shot glass.

A New Home for the Northern Miner

You might have heard the news already: Glacier Media has sold The Northern Miner, Mining.com, Canadian Mining Journal, and other assets to Earthlabs (TSXV:SPOT) in a $4 million deal.

I hear that, after adjustments, including accounts receivables, the final deal will be closer to $3.5 million, giving it about a 1X revenue multiple.

My initial reaction was envy! I have a deep affection for The Northern Miner brand and its team, and in my eyes, the MINING.com domain alone is worth a good chunk.

The Northern Miner's century-old archive is rich with historical data, and Earthlabs has a history of using AI to uncover new gold prospects.

Earthlabs is in an interesting spot, with net assets more than twice its current market value. There's a holding company discount, a bit of investor confusion, and room for more insider ownership.

You might remember that in 2021, I sold CEO.CA to this crew when they were Goldspot. And I'm still a shareholder. You can catch them talking about the takeover here.

On The Northern Miner deal, I connected the buyer and seller last year— without a finder agreement. Pray for me.

The Best Investment You Can Make in Junior Mining

In my opinion, Jay Martin is mining’s best millennial communicator.

As the head of Cambridge House conferences, Jay's industry knowledge is second to none.

He runs a fantastic newsletter about investor psychology and how he manages his own portfolio. It’s a must subscribe at $100/year.

This past year, Jay has been developing a new video course for commodity speculators.It’s incredibly interesting and valuable.

For a limited time, you can get his entire library of video lessons for only $149.

I'm currently exploring this outstanding asset, and without a doubt, it's the wisest investment you can make in this industry.

Sign up here: The Commodity University

Speaking of a whiskey bottle into a shot glass, my 2 year old just left the water running upstairs. See you next time.

Enjoy The Big Score? Share with anyone who may be interested. A writer wants his ideas out there, and your help is greatly appreciated.

More Tommy on X.com

The secret hack to the human operating system - How to manipulate others’ emotions for shared joy