The Golden Partnership

Thriving Through Unity, Resilience, and Friendship

“In a firefight, the soldier you share a foxhole with takes responsibility for 180 degrees, and you take the other 180 degrees. Your buddy and you literally fight back to back.” Charles Colson

This very principle, of unity and collaboration, isn't just confined to battlefields; it resonates deeply in the world of business.

Partnerships hold the extraordinary power to unlock hidden potential and amplify the brilliance within individuals and ideas. The following story is an inspiring illustration of this power.

In May-June 1944, the world was reeling under Nazi desperation and over 400,000 Hungarian Jews met their tragic fate in gas chambers. Amidst this turmoil, a 16-year-old Peter Munk emerged as one of the fortunate ones. A daring offer to save a million lives halted, yet his escape on a train with 1700 souls marked the beginning of a new chapter. Through the last of his grandfather's belongings, he embarked on a journey to Canada, where he embraced new beginnings while pursuing electrical engineering at the University of Toronto.

On the other side of the spectrum, young David Gilmour's struggles seemed trivial by comparison. A cancelled camping trip and financial hiccups during a European holiday paled in comparison. Gilmour, a tall figure, exuded confidence with a gentle demeanour, courtesy of his Canadian Establishment upbringing.

Despite their seeming dissimilarity, a swift bond formed in 1952 at a Toronto restaurant. Munk's initial interest in Gilmour's companion sparked a conversation that laid the foundation for their remarkable six-decade-long business journey. Gilmour fondly remembered that from the very start, they felt a mutual destiny to collaborate. "There's this spark between us, back then and even now," he recounted.

Their maiden venture fused their individual professional paths. Munk's engineering background converged with Gilmour's focus on importing Scandinavian furniture, birthing Clairtone Sound Corporation in 1958. Their revolutionary design and pioneering sound technology turned their creations into global status symbols during the Swinging '60s. Even Hugh Hefner adorned the Playboy Mansion with their units. "Listen to Sinatra on Clairtone stereo. Sinatra does," boldly proclaimed one of their groundbreaking advertisements.

As sales soared, Munk and Gilmour became industry luminaries. However, like many tales of rapid expansion, Clairtone faltered in the mid-'60s and sought capital infusion. Gilmour had already leveraged his house for the company, and when Clairtone sought assistance from Nova Scotia's development agency, an ambitious factory project turned into a financial quagmire. Ultimately, Munk and Gilmour were ousted from their own creation. By 1972, Clairtone had faded away.

It was the most agonising of their business experiences, Munk later reflected. Yet, Clairtone bestowed upon them a crucial lesson: together, they could do more together than apart.

With reputations and finances in shambles, Munk and Gilmour stood at a crossroads, this time in a different industry and corner of the world.

While Clairtone was entirely original, their next idea was borrowed.

One quiet evening at Munk’s cottage in Georgian Bay, Ontario, a friend left behind a prospectus for a Bahamian real estate development featuring artificial lakes and a golf course. The world's elite were snapping up lots, with shares in the developer soaring 500% on the stock exchange.

Munk's curiosity piqued, and as he skimmed through the document before retiring for the night, a revelation dawned the next morning. Back in 1962, he and Gilmour had invested in a development site in Fiji, poised for the burgeoning tourism industry. But the idea had slipped their minds. Could the Bahamas concept be transplanted to Fiji? Gilmour posed as a prospective buyer in London, gaining invaluable insights into its business framework.

With meticulous attention to detail, they crafted investor presentations for their new venture, Southern Pacific Properties (SPP). Munk steered strategy and projections, while Gilmour hit the road to secure funding. Their commitment to near-perfection propelled SPP towards triumph.

Their partnership bore fruit when Gilmour crossed paths with acclaimed financier Jim Slater in London, altering SPP's trajectory. The acquisition of Australia's largest hotel chain expanded their horizons.

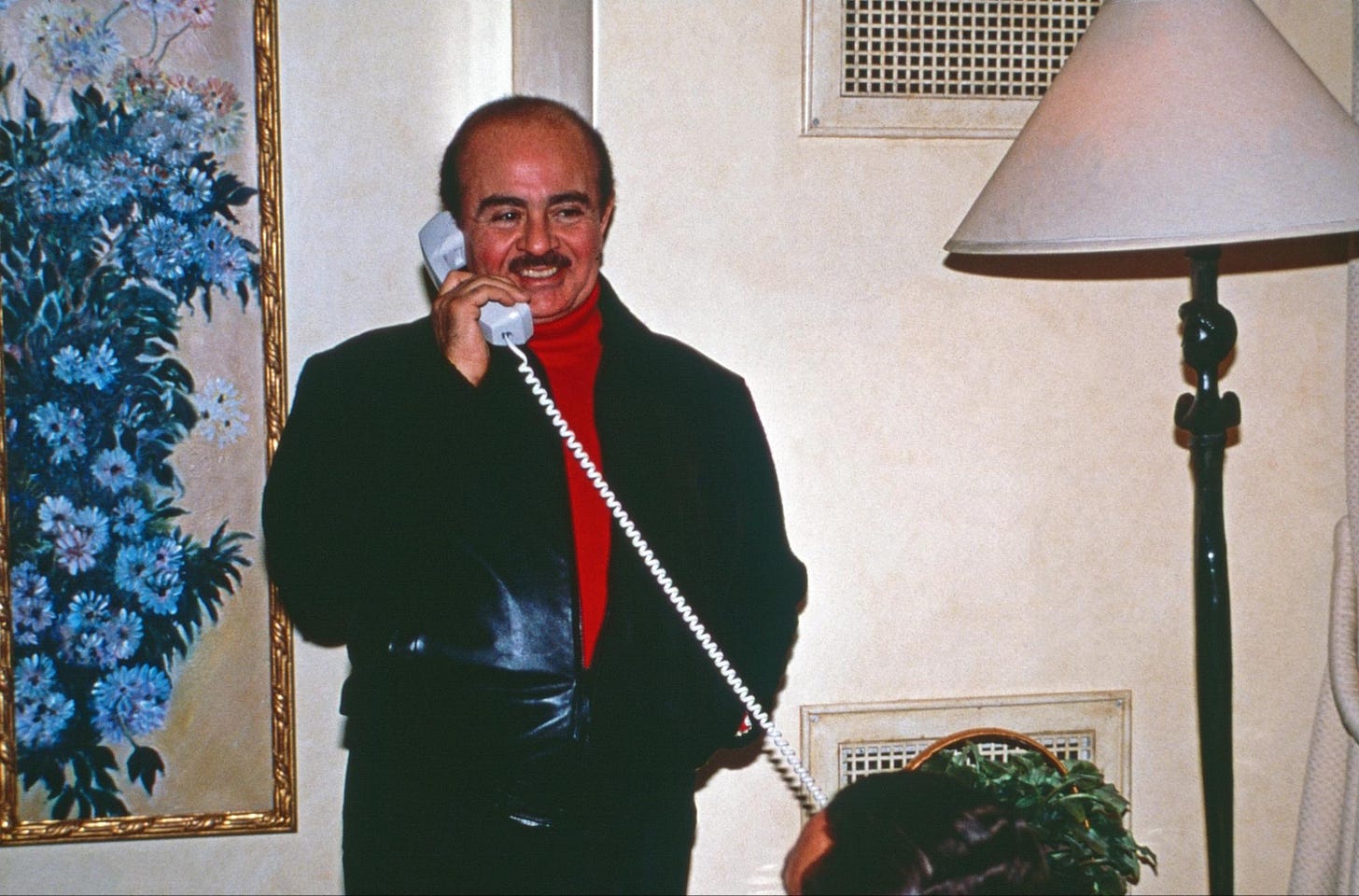

SPP harboured lofty visions, envisioning a championship golf course and a grand resort near Egypt's iconic Giza pyramids. However, government support crumbled just before fruition. Assisted by arms dealer Adnan Khashoggi, SPP transitioned into private ownership in 1978 and was subsequently sold in 1981 for $130 million, generating an astonishing windfall exceeding $500 million in today's currency.

However, Munk and Gilmour's journey held more twists. Their most significant commercial successes still lay ahead, awaiting discovery.

Unable to secure the trade name "Carrick," the impromptu choice of "Barrick" was made for their joint company.

They paid themselves a $30 million dividend, with Gilmour even acquiring a lavish home in Lyford Cay, Bahamas (later sold to actor Sean Connery). Barrick's remaining balance flowed into the oil and gas industry, only to vanish swiftly.

After decades of ups and downs, there they were again, back at the drawing board.

Gilmour, inspired by Winston Churchill, embraced failure and enthusiasm as the twin companions of success. Munk's vision found a home in the gold business, focusing Barrick on North American mining to shield investors from African turmoil and inflation's grip.

While Munk was firmly in charge of Barrick, Gilmour was often called in to forge key relationships or smooth things over. Munk's operating style mirrored 'crossing the Rhine,' as his daughter Nina aptly put it. He thrived on the offensive, tackling takeovers and plotting strategies. Despite setbacks, their bond persevered.

In 1983, Gilmour faced unbearable tragedy as his daughter was brutally murdered. Munk stood as his pillar, guiding Barrick's ascent through acquisitions like the Goldstrike mine. The outcome was remarkable—Barrick transformed into the world's largest gold producer.

Gilmour's legacy intertwined with Barrick for twenty-five years, while his later Fiji ventures, including the Wakaya Resort and Fiji Water, carried his daughter's memory forward.

Munk's aspirations extended beyond mining. Alongside Gilmour, he ventured again into commercial real estate, acquiring TrizecHahn in 1994 at a 15 year low in valuations. It expanded until a $8.9 billion sale was reached in 2006. Munk's audacity persisted into his golden years, exemplified by a super yacht port in Montenegro. His passing at 90 marked the conclusion of a remarkable legacy. Gilmour's departure followed, preceded by a belated but welcome arrest in his daughter's cold case after nearly 40 years.

Although some of their later ventures were pursued independently, their friendship remained strong. Gilmour warmly recalled, "Peter is the brother I never had." He recounted an anecdote from their 80s, a stroll through Manhattan where their engrossing conversation caused them to overshoot their destination by 10 blocks. The spark that ignited their friendship over half a century before still burned brightly.

In a nutshell, their story proves that when people work together, good things happen. They didn't just do well in business – their teamwork had a big impact. Their friendship and shared experiences made their partnership strong, lasting through tough times.

The tale of Munk and Gilmour teaches us to be the kind of partner we seek. By working together, they created amazing successes, showing how unity can make a huge difference.