Golden Surprise at ARIS Mining

Unheard of $11 million Segovia plant expansion could yield 100,000 ounces of additional gold production, $80+ million in annual EBITDA, from early 2025

Imagine turning $11 million into $80+ million annually for several years starting in just ~15 months.

That's the power of the Maria Dama gold plant expansion at Segovia (pictured), announced today by ARIS Mining (TSX:ARIS, NYSE:ARMN), set for completion by early 2025.

This unexpected news is one of the biggest no-brainers I’ve seen in the gold space.

This is from a conservative management team with a track record of delivering.

The Segovia plant expansion is on top of the $300+ million annual EBITDA ARIS expects from 2026 onwards. Currently, the company’s market cap is just $398 million (all figures US Dollars), and ARIS is fully funded to achieve its goals.

Last year, the Maria Dama plant increased its capacity from 1,500 to 2,000 tonnes per day (tpd) successfully. The plan will boost the plant's processing to 3,000 tpd using an idle ball mill, increasing gold recovery and reducing costs.

Shareholders will find this a pleasant surprise. I've spoken with ARIS management. They said nothing about a ball mill, bought but not used, waiting, its potential for production and recoveries untold.

The result will grow annual gold production at Segovia from 200,000 to 300,000 ounces, potentially taking ARIS's total production in Colombia beyond 500,000 ounces from 2026.

Additionally, Segovia's gold reserves have risen by 75% to 1.3 million ounces with a reserve-only mine life of 7 years at current operating levels (excluding today’s expansion). But with its 150-year history and exploration potential, Segovia’s future looks promising. The site has over 3.6 million ounces in measured and indicated resources already with drills turning.

The expansion could add $80+ million to annual EBITDA (YTD AISC of $1,139/oz: Nov ‘23 Presentation) at $2,000/oz gold, on top of the $156.1 million generated at Segovia in the past 12 months.

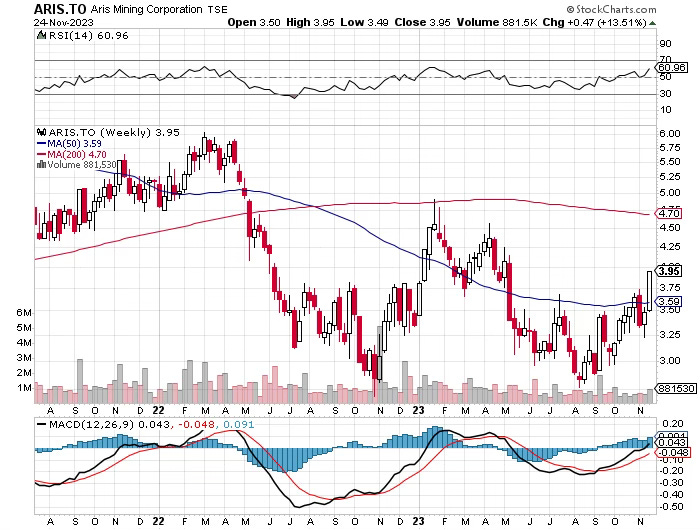

Even though the stock went up 13% last week, breaking out of a technical resistance level at $3.60, the expansion of the Segovia plant suggests that ARIS might be a better investment now than ever before.

Five large-scale projects including Segovia have the potential to transform ARIS into a leading mid-tier gold producer. They're building the 8.6 million ounce (M&I+Inferred) Marmato Lower Mine, where first gold is expected in late 2025 with a ~20+ year mine life. The company owns a 20% stake (with an option to buy another 30%) in Soto Norte, a potential 450,000/oz/yr producer at all in sustaining costs below $500/oz. ARIS owns a 6.6 million ounce (M&I+Inferred) gold-copper project in British Guyana and a potential multimillion ounce exploration asset in Canada as well.

Financially solid, ARIS has $210.8 million in cash, $122 million in available project funding, and debt of $373.3 million on favourable terms (majority at 6.8% due in 2026).

Today’s announcement is just one example of ARIS's levers to grow shareholder value.

To me, ARIS Mining (TSX:ARIS, NYSE:ARMN) is the top gold investment right now.

DISCLAIMER: This editorial has been prepared by Tommy Humphreys, a shareholder of ARIS Mining, and consequently, does contain bias in its discussion of the company. The views expressed herein are those of the author and do not represent the views of ARIS Mining. Mr. Humphreys has not received any compensation from ARIS Mining or any third parties for producing this communication. Past performance should not be taken as an assurance of future outcomes. This communication may contain inaccuracies. Please refer to ARIS Mining's SEDAR+ profile for important risk disclosures. There is a possibility that certain projections may not materialize, and unforeseen risks could surface, resulting in either partial or total losses for shareholders. The author retains the right to trade any security, including ARIS Mining, without prior notice. Tommy Humphreys and TheBigScore.com are not licensed financial advisors and are not qualified to offer individual financial advice.

Aris is definitely shooting higher this morning..........thats definitely a positive sign