5 Lessons From First 50 Bagger: My Aaron Hoddinott Story

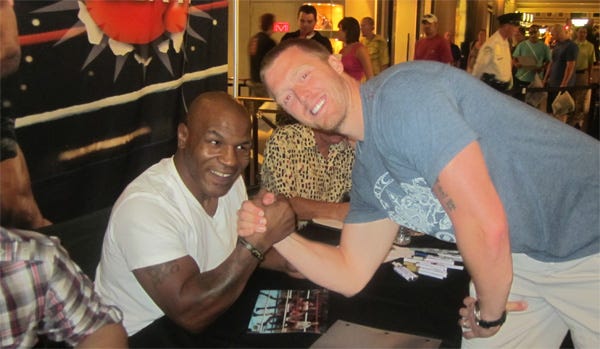

Mike Tyson and Aaron Hoddinott. Hoddinott delivered returns of approximately 50X to early investors in NexOptic.

As a 21-year-old first-time entrepreneur running a web development business, I once spent an hour on the phone with one of my biggest competitors, posing as a potential customer.

I enjoyed talking to the guy so much I eventually confessed that I was actually a mole who was trying to learn his secret sauce so I could compete with him. He thought that was funny, and we ended up becoming friends. He convinced me the web development space was crowded and that I’d be better off developing my own product, rather than consulting for others. It was an invaluable early lesson.

I soon started theCEO.CAsite after paying an ounce of gold and about $2,500 cash to a few old friends to buy the domain in 2012.CEO.CAwould be a blog about Canada’s top investors and monetized through advertising, as soon as I figured out some of the legal requirements of working with public companies.

PinnacleDigest.comwas a Canadian stock market community and promotions business that I respected and wanted to emulate. Through a friend, I arranged a call with Aaron Hoddinott, one of the site’s founders, to size him up and ask a few questions. Just like my friend the web developer, Aaron was extremely helpful. He offered to lend us his legal disclaimer, and made an intro to his lawyer, so I could stay out of trouble. This act of kindness gave me the confidence to develop CEO.CA, and Aaron did it despite the fact we were direct competitors.

A couple years later, I got a call from Aaron inviting me to learn about a new public company he was starting. He had met a pair of scientist brothers from Calgary who had developed flat-lens technology that could potentially revolutionize lenses in everything from mobile phones to weaponry and telescopes. I attended the presentation, but quickly grew frustrated by the limited information they were sharing about the opportunity. I refused to sign a confidentiality agreement and walked out of the meeting in a fuss. Looking back, I was being a bit of a baby.

Just as I was getting into the elevator, Aaron came and stopped me. He calmly convinced me to hear them out. I returned to the presentation and eventually came around. They were sincere and had a big idea, so I gave them a little gambling money and forgot about it for the next year, while the stock was halted, dealing with regulatory issues.

My expectations were low. I thought the long-halt period was not a good sign, and had mentally written off my investment, when Aaron called again to let me know the company would finally start trading in early 2016.

The NexOptic team

NexOptic launched on the TSXV last year to great success. The $0.05 stock I bought was now worth $0.50, and the full warrants attached to the seed financing entitled me to double my position at $0.10. This was one of my best bets ever, and I slowly sold the position to pay some debts and save up for a house.

Aaron Hoddinott had not only helped me start my business, but he handed me a nearly 20-fold return in a little over a year.

It is fair to say our relationship is a little one-sided, and I owe him, big time! I consider myself to be very fortunate for many reasons, and my relationship with Aaron is near the top of that list.

Today NexOptic hit $1.30, and my original investment would have been worth approximately 50X what I paid for it just 2 years ago if I had held on. It appears NexOptic’s technology is catching on and global investors are taking notice. While I wish I held on to more stock, I will never be disappointed about this return, and a few of the lessons learned:

1. You get rich with people your own age

I spent the first few years at CEO.CA chasing the most successful investors of previous cycles, but these titans were already well-known to the market, so their opportunities were more expensive out of the gate. These lions were also rich already, which can be a demotivator in itself. NexOptic was one of my first bets on a millennial promoter and it worked fabulously. I soon backed the 27-year-old CEO of Lithium X Energy, and CEO.ca subscribers saw 15-cent shares reach $2.85 within 6 months of that financing. That’s why I’m excited to continue to speculate on millennial management teams in the small-cap space, especially people like Aaron, who go out of their way to help fellow entrepreneurs.

2. Public venture capital works well for moon-shot ideas, not small businesses

It is hard enough to build a successful venture-stage company let alone to do it in a public company, where there are significant annual costs and regulations to comply with. When speculating in venture stocks, like those that trade on the TSXV and CSE, look for ideas that have big potential or binary outcomes. Flat lenses had the potential to make mobile phones thinner, and that alone was a deca-billion dollar idea. Just because you find a well-run business doesn’t mean it will do well in a public company. If a venture is to be publicly traded, it should have the promise of scale.

3. Befriend your competitors

Entrepreneurs have a habit of helping one another, so reach out to your competitors and those who you want to emulate. You have nothing to lose, and your competitors can help you avoid their mistakes and potentially share some larger opportunities. The more relationships you have with entrepreneurs and business people you respect, the better your odds are of catching the next home-run opportunity. Investor Wayne Deans taught me that entrepreneurs are always the best stock pickers.

"Don't listen to everyone with an opinion" - Famed Canadian investor Wayne Deans in Vancouver. CEO.CA photo

4. No expectations, no disappointments

Having written NexOptic off in the year it was halted from trading, the surprise success tasted even sweeter when it ultimately materialized. Low expectations are always a good idea, particularly in the small-cap space. It reminds you to not risk too much money on a speculative idea. Successes like NexOptic are the exception, not the rule.

5. Hold on for the ride

Expensive stocks have a habit of getting more expensive. When the stock market gods are kind enough to give you a significant return on your investment, you are obligated to take some money off the table. However, in the case of NexOptic, I should have held on to some of the position to be enjoying the current highs. I know that Aaron and his partner Alexander Smith have held on, and the success they are enjoying is well deserved!

Tommy Humphreys is a Vancouver, Canada-based entrepreneur and investor. He is the founder of CEO.CA, a free stock market chat and research site. If you are looking to grow your wealth, you should register and download the “CEO.CA” app in iTunes and Google Play.